Monday-Friday

8:30am-Noon

1:00pm-4:30pm

Monday-Friday

8:30am-Noon

1:00pm-4:30pm

Lately, we’ve been hearing about more and more people dipping their toes – or heck, diving head first – into the gig economy with Ridesharing apps. Need some extra cash? Drive for Uber on the weekends, or drop off a couple of Instacart deliveries after school. It seems easy and painless, so why not, right?

While yes, modern apps make jumping into a Ridesharing job quick and easy, ensuring you have the right insurance coverage requires a bit more work. You can’t assume (as most people do) that your standard personal auto policy will cover all of your needs, so we’d like to shed some light on how Ridesharing can affect your coverage.

When you hear Ridesharing, you probably think of the main people transportation apps like Uber and Lyft, but did you know the term can mean much more than that? In legal terms, “Ridesharing” actually refers to Transportation Network Companies (TNCs), which use apps or digital networks to connect customers requiring the transportation of people, groceries, or fast food with drivers who use their own vehicles to provide transportation. That means even DoorDash and Instacart drivers (and so many others!) are technically offering Ridesharing services, and gaps in insurance coverage can appear before the first ride is even accepted.

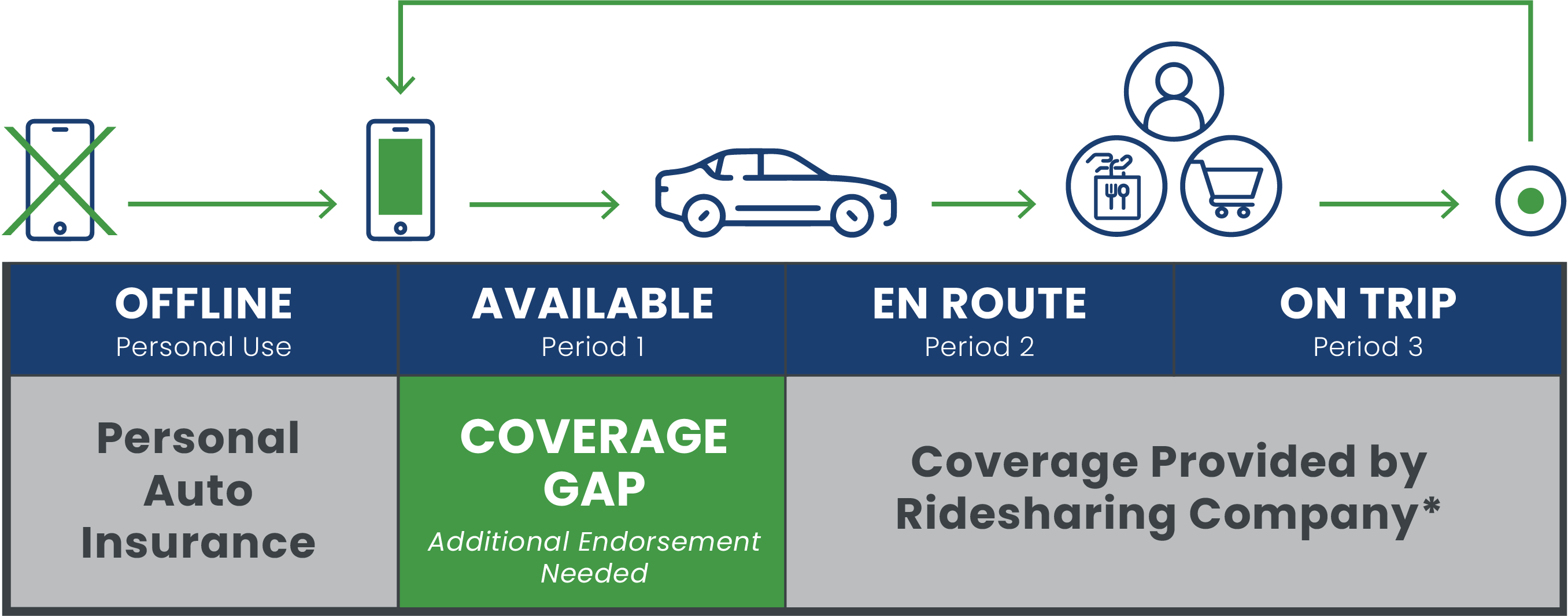

Most TNCs provide coverage once the riders (read: people OR goods) enter the car. And your personal auto policy covers you while the Ridesharing app is turned off. But that middle ground, between turning on the app and accepting a ride – defined in TNC terms as “Period 1” or “Available” – actually has no coverage from either the TNC or your standard personal auto policy. To fill this coverage gap, you must purchase a Ridesharing endorsement on your auto policy that accounts for these activities.

*We recommend you confirm coverage with your TNC.

*We recommend you confirm coverage with your TNC.

This has caught so many people we’ve talked to off guard. In particular, we’ve talked with several parents whose college-aged students were accepting Rideshare jobs on the weekends without their parents’ knowledge, and were thus putting themselves at risk by having no coverage for any time they were “Available” in the app. We encourage all households with multiple drivers to talk about Ridesharing and make sure you know whether anyone on your policy requires the additional Ridesharing endorsement.

Please contact us if you have any questions. We’re here to help address gaps in your coverage, and we’re happy to set up a review to make sure you have the right coverages in place.