Monday-Friday

8:30am-Noon

1:00pm-4:30pm

Monday-Friday

8:30am-Noon

1:00pm-4:30pm

Lately, we’ve been hearing about more and more people dipping their toes – or heck, diving head first – into the gig economy with Ridesharing apps. Need some extra cash? Drive for Uber on the weekends, or drop off a couple of Instacart deliveries after school. It seems easy and painless, so why not, right?

While yes, modern apps make jumping into a Ridesharing job quick and easy, ensuring you have the right insurance coverage requires a bit more work. You can’t assume (as most people do) that your standard personal auto policy will cover all of your needs, so we’d like to shed some light on how Ridesharing can affect your coverage.

When you hear Ridesharing, you probably think of the main people transportation apps like Uber and Lyft, but did you know the term can mean much more than that? In legal terms, “Ridesharing” actually refers to Transportation Network Companies (TNCs), which use apps or digital networks to connect customers requiring the transportation of people, groceries, or fast food with drivers who use their own vehicles to provide transportation. That means even DoorDash and Instacart drivers (and so many others!) are technically offering Ridesharing services, and gaps in insurance coverage can appear before the first ride is even accepted.

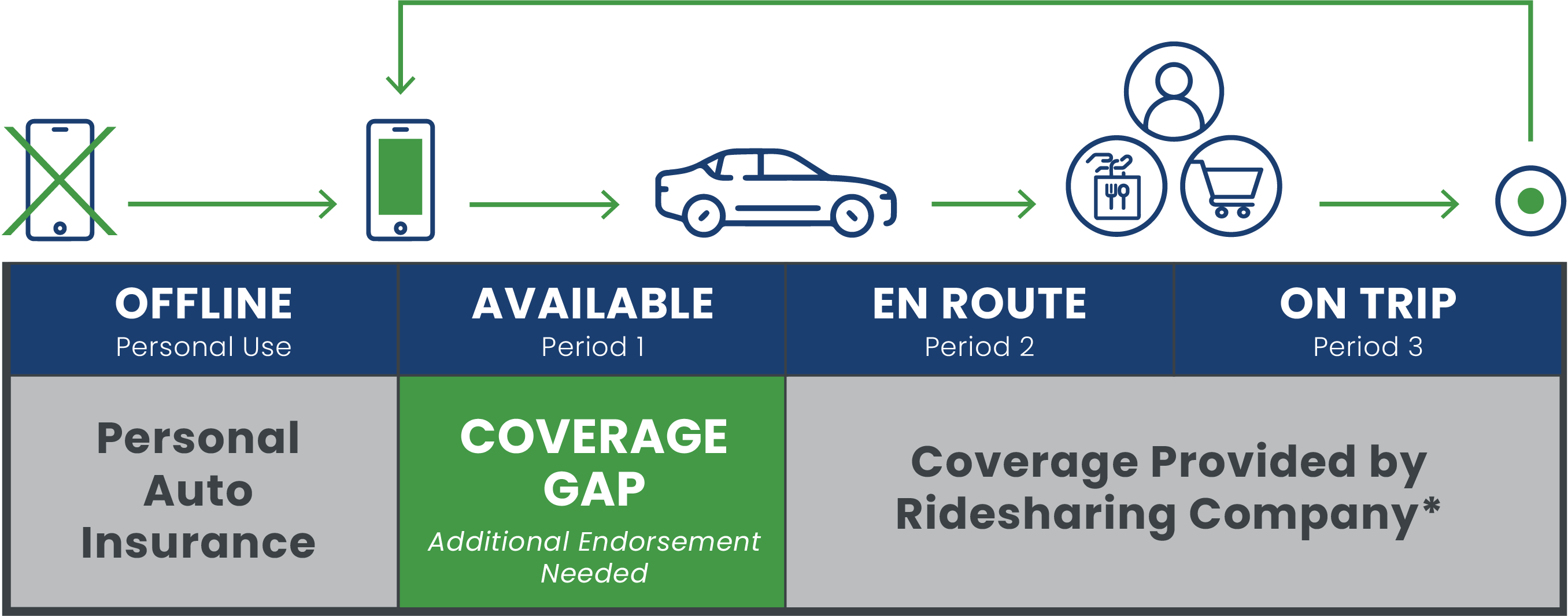

Most TNCs provide coverage once the riders (read: people OR goods) enter the car. And your personal auto policy covers you while the Ridesharing app is turned off. But that middle ground, between turning on the app and accepting a ride – defined in TNC terms as “Period 1” or “Available” – actually has no coverage from either the TNC or your standard personal auto policy. To fill this coverage gap, you must purchase a Ridesharing endorsement on your auto policy that accounts for these activities.

*We recommend you confirm coverage with your TNC.

*We recommend you confirm coverage with your TNC.

This has caught so many people we’ve talked to off guard. In particular, we’ve talked with several parents whose college-aged students were accepting Rideshare jobs on the weekends without their parents’ knowledge, and were thus putting themselves at risk by having no coverage for any time they were “Available” in the app. We encourage all households with multiple drivers to talk about Ridesharing and make sure you know whether anyone on your policy requires the additional Ridesharing endorsement.

Please contact us if you have any questions. We’re here to help address gaps in your coverage, and we’re happy to set up a review to make sure you have the right coverages in place.

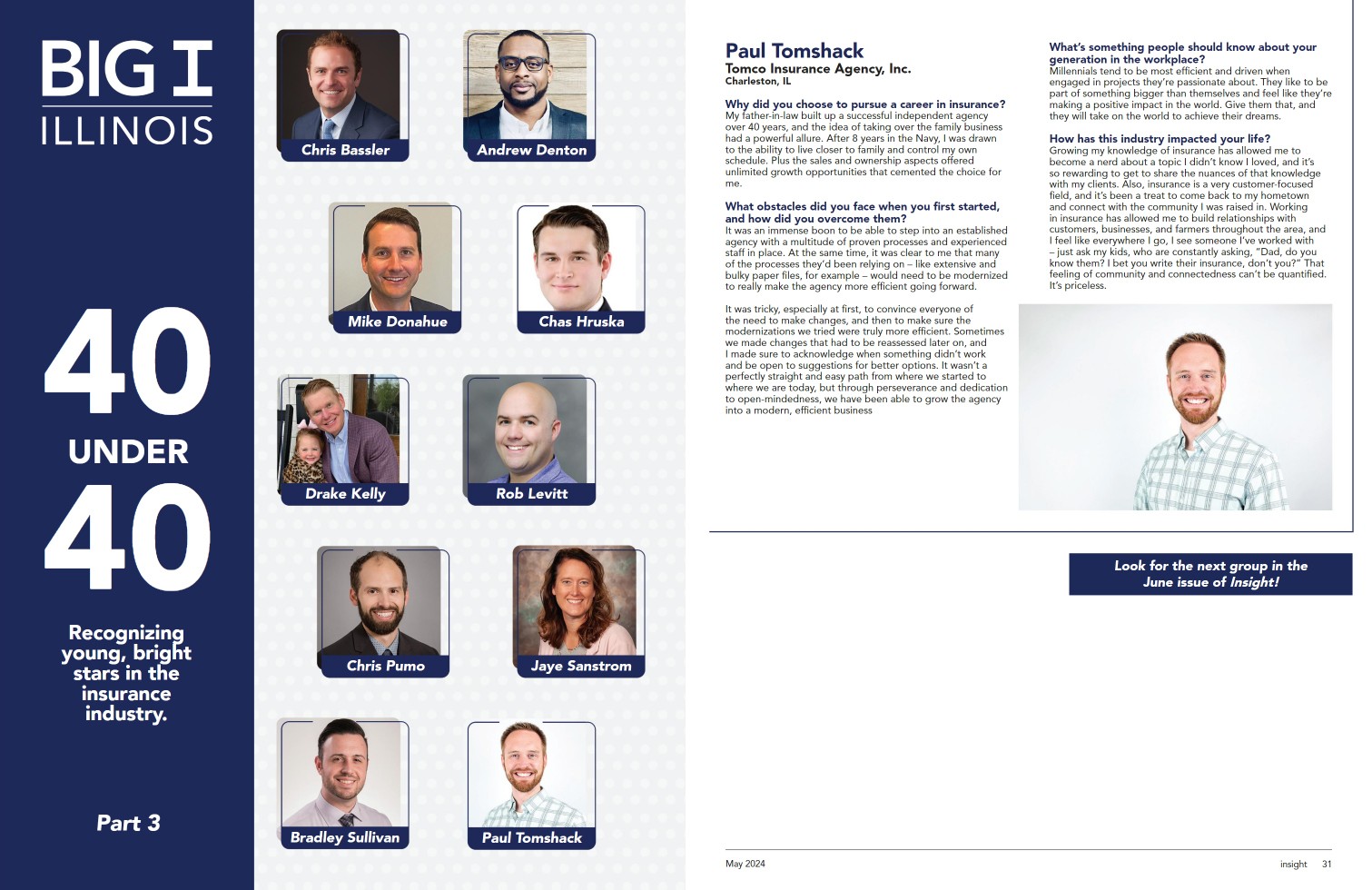

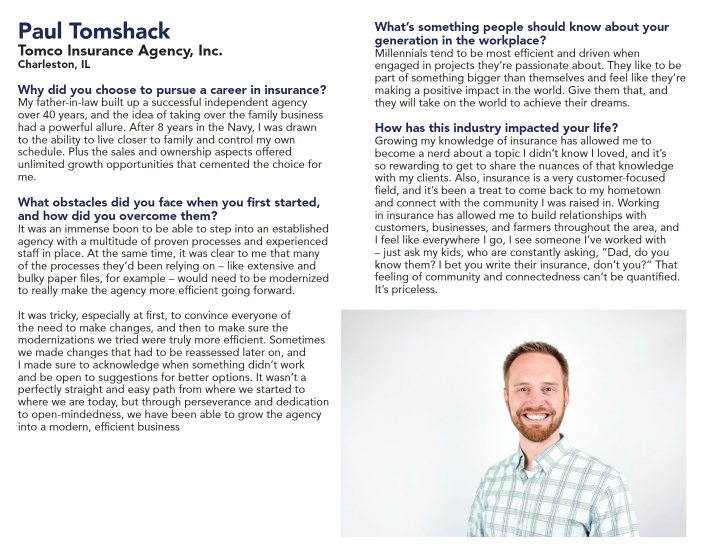

Paul Tomshack was honored to be named one of Big I Illinois's 40 Under 40 in the latest issue of Big I's Insight magazine!

Big I Illinois, formerly known as the Independent Insurance Agents of Illinois, has been supporting independent insurance agents and consumers throughout the state for 125 years. Their 40 Under 40 spotlight recognizes "young, bright stars in the insurance industry."

Paul was thrilled to be recognized as one of the top 40 agents in the state of Illinois.

You can find Paul's highlight on page 31 of Insight magazine's May issue.

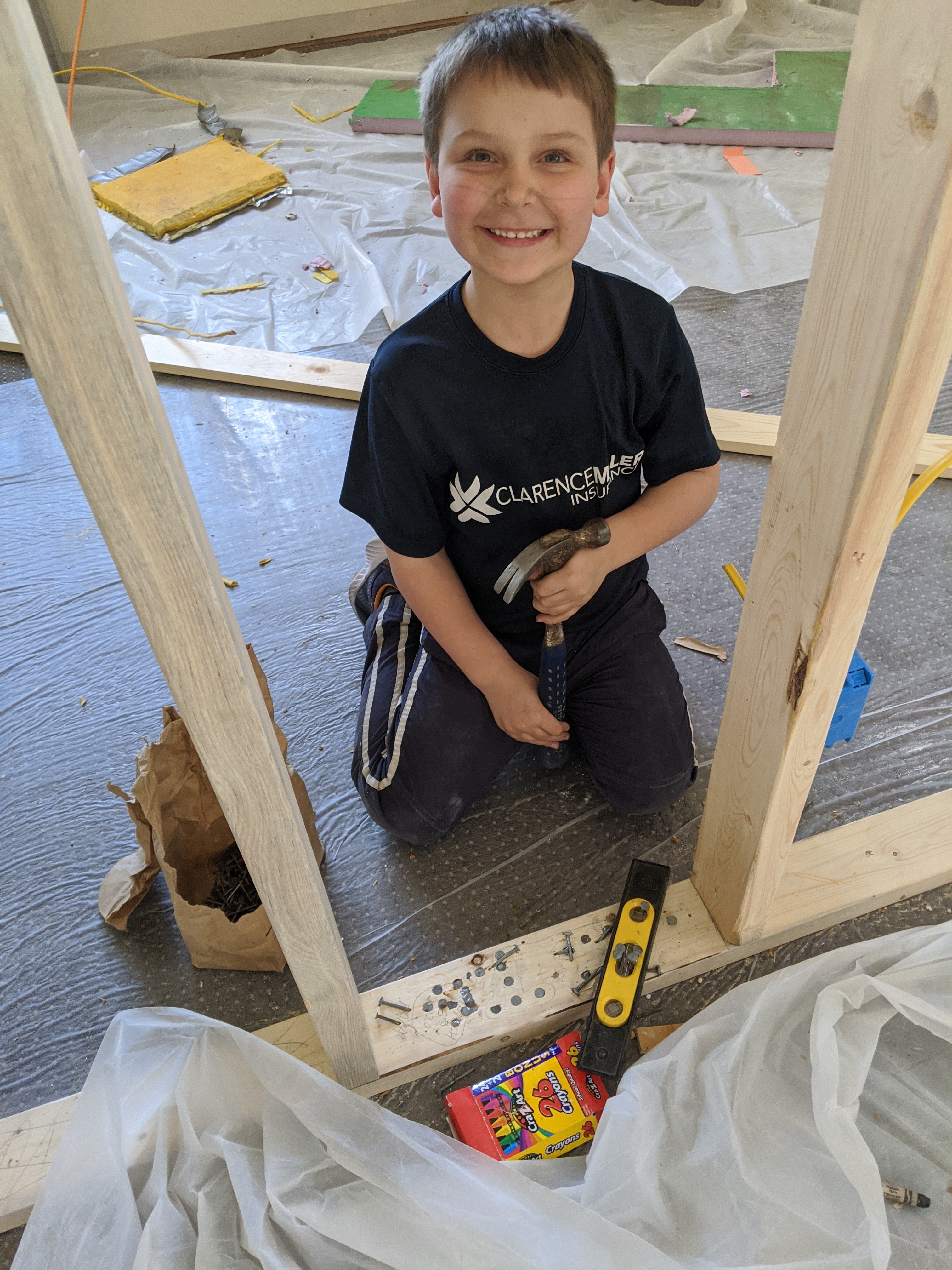

In spring of 2020, when Covid sent all public spaces into lockdown, Tomco joined the world in closing our office and moved to doing business entirely remotely. As the office sat empty, Paul and Clarence saw an opportunity to remodel an aging building and remake some of our office spaces into more useful real estate in the process. Cue the Great 2020 Tomco Remodel!

We tore down existing walls and built new ones in their place, reshaping the lobby area and dividing office spaces to create two new conference rooms for meeting with customers. We put in all new flooring throughout the building, painted every wall, and wired new lights in the freshly divided spaces. We replaced all the old furniture with adjustable standing desks and modern chairs and built a custom lobby desk to greet customers. In short, we took a space that was mostly working for us and made it incredible. We couldn't be more pleased with how it all turned out.

Perhaps the coolest part of the remodel is that it was done almost entirely by Paul and Clarence (with some help from Paul's son / Clarence's grandson Lucas :)). We thought you'd enjoy seeing the process of how the building was transformed, since no one was able to see it during the actual remodel. Enjoy our pictures!

We’re sure you’re thinking, “Wait, how can Illinois run out of insurance?” The answer is not a simple one, as it involves several different economic factors whose untimely overlap has caused unprecedented disruption in the insurance industry. We’ll do our best to break down this complex situation so you can understand any changes you may be seeing in your own policies.

Reduced reinsurance is driving changes across the industry. Insurance companies rely on larger, reinsurance companies to back their claim payouts in the case of catastrophic weather events. Unfortunately, this year reinsurance companies have severely limited the amount they’re willing to offer insurance companies to cover their claims, leaving them over-exposed in the event of a disaster.

And those disasters have been happening with increasing frequency lately. Even excluding the major hurricanes in the East and wildfires in the West, we have seen a huge increase in smaller “convective storms,” including tornadoes, derechos, straight-line winds, hail and even lightning, especially in the Midwest. Data from the National Oceanic and Atmospheric Administration shows that from 1980 to 2005, the US saw just 2 to 4 severe convective storms per year that produced losses of $1 billion or more. During the last 6 years, that number has jumped to 18 such events annually, on average.1 And in just the first 9 months of 2023, we have had 23 extreme weather events nationally that cost at least $1 billion, totaling more than $57.6 billion in damage.2

The increased volatility in the weather, combined with worldwide economic policies, has resulted in fewer venture capitalists placing their investments with reinsurance companies. But the need for reinsurance coverage has only gone up as catastrophic storms have become more frequent. As the surging demand has collided with the diminished supply of available reinsurance, steep rate increases in reinsurance premiums and higher deductibles for insurance companies have followed.

As a result, insurance companies are now paying higher reinsurance premiums and are responsible to pay out significantly more catastrophic claim dollars each year. It is not an exaggeration to say that insurance companies have never seen anything like this, and it has shaken the industry to its core.

Insurance companies are being forced to make dramatic changes to how they do business. The sudden and unexpected contraction of the reinsurance market has left insurance companies feeling over-exposed. As a result, many insurance companies have made similarly sudden and unexpected changes to their own business guidelines. We have entered what’s called a “hard market,” in which insurance companies become so restrictive that it becomes genuinely “hard” to buy insurance.

Some examples: almost of all of our companies have had to become more selective in who they’re willing to insure, and many have had to pause accepting new customers altogether as they attempt to deal with the dual events of increased catastrophic claims and reduced reinsurance coverage to pay for them. Customers are also having to share more in the cost of their claims in the form of higher deductibles. Claim coverages are changing, as most companies transition to covering roofs at their current values at certain ages, rather than at full replacement cost. And of course premiums are rising by eye-popping amounts, as increased catastrophic losses drive increases in rate.

Widespread advice from many of our companies is that if you currently have insurance coverage, keep it. If you need new insurance, be prepared for a potential uphill battle to find the coverage you need. We here at Tomco will always strive to help you find the most competitive coverage at the most competitive cost, but be aware that if you’re searching for new coverage, your available choices may be limited for the foreseeable future.

What are we doing at Tomco to help you weather this storm? We know the current hard market is challenging (believe us, we know), and we want you to know we’re doing everything we can to help you get through it.

As new updates are announced, we are constantly evaluating the changing coverages and premiums and comparing them to our available options. We continue to partner with multiple companies to ensure we have the largest number of options possible, and we are continually looking for alternative coverages or policies that might serve you better. Our goal is to be proactively searching for and reaching out to you with options if we find them, so you can rest assured that the policies you have are your best option at this time.

Please don’t hesitate to contact us if you have questions, and know that even with our increasingly limited options, we are committed to giving our very best effort to find the coverages that work for you. Illinois hasn’t quite run out of insurance yet, and it is our hope that the extreme conditions we’re seeing in the industry will ease sooner rather than later. Until then, we encourage you to practice your patience and reach out to us with your questions. Together, we will make it through this.

1 Insurance Journal, “Is Industry Prepared? Hail, Convective Storms, Population Now Driving Billions in Losses,” October 4, 2023

2 Insurance Journal, “US Already Sets Record for Yearly Billion-Dollar Weather Disasters,” September 13, 2023

Inflation has been a topic at the forefront of developing news. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index for All Urban Consumers rose to 7% in 2021.

Insurance Companies are experiencing the effects of inflation as well. They now require additional funds to repair or replace buildings, equipment, and/or autos during claims. This has to do with several market factors involved in settling claims:

Many people are unaware that it is their responsibility to confirm the value of their property is correct, not the insurance company’s. If property, which including dwellings, outbuildings, and farm equipment, is under-insured (by more than 20% for most policies) at the time of a claim, most policies include a "co-insurance" clause, in which the percentage at which you were under-insured is calculated and deducted from the claim payments.

Keeping up with correct property values becomes a more urgent concern during periods of high inflation because rapidly rising values can increase the likelihood that the co-insurance clause could get applied.

As if that wasn’t complicated enough, the insured value of your property can be different depending on if your insurance policy has a Replacement Cost settlement (which does not depreciate your home or property’s value based on age) or Actual Cash Value settlement (which applies depreciation based on age).

Our Agency can assist in correctly determining the insurance value of your home, outbuildings, and other property to help minimize the chance of being under-insured. Reach out to us today to set up your policy review.

We’re happy (and sad) to announce Clarence's retirement on June 1st, 2022, after 48 outstanding years.

We’re happy (and sad) to announce Clarence's retirement on June 1st, 2022, after 48 outstanding years.

Clarence founded the agency along with his wife, Linda, and they have been a big part of the Agency's success. He earned his bachelor’s degree from EIU in 1972, and he started selling Life insurance in 1974. In 1977, he started Clarence Miller Insurance with the purchase of the Doyle Johnson Agency. Over the years, he served on Agent Advisory Committees for multiple insurance companies and oversaw the agency becoming the premier insurance agency in the Coles County area.

He has been a great mentor, helped countless customers, and been a reliable resource and friend to us all.

Here’s a personal note from Clarence:

I have enjoyed my time with you and feel fortunate to have been able to say this. It is a true blessing to enjoy your job, but it is time for me to say goodbye! I will miss all of you.

Please join us in congratulating Clarence on his service, leadership, and friendship over the past 48 years. We wish him all the best!

~ The Tomco Team

We treasure the close and trusting relationships we have with our clients, so we wanted you to be the first to know. As of this February, we have changed the name of our agency to Tomco Insurance Agency.

When we first opened our doors in 1977 as Clarence Miller Insurance, Clarence and Linda were the only employees. We have grown and evolved over the last 40+ years, and we are now represented by a team of six employees. Our new name, Tomco, is short for Tomshack & Company, a fitting reflection of how together we work as a team to fulfill your insurance needs.

Along with this name change, we are excited to unveil an updated website to help make insurance simpler for you: "TomcoAgency.com". We will also be updating our email addresses to match. To contact us, simply replace the @clarencemillerins.com in our emails with @tomcoagency.com. Emails sent to the old addresses will continue to be received for the time being, but we urge you to update your contacts as soon as possible.

We are grateful to you not only for allowing us to serve your insurance needs, but also for your loyalty and friendship. You are truly an important member of the Tomco family, and we look forward to working with you for many years to come.

With appreciation,

~The Tomco Team